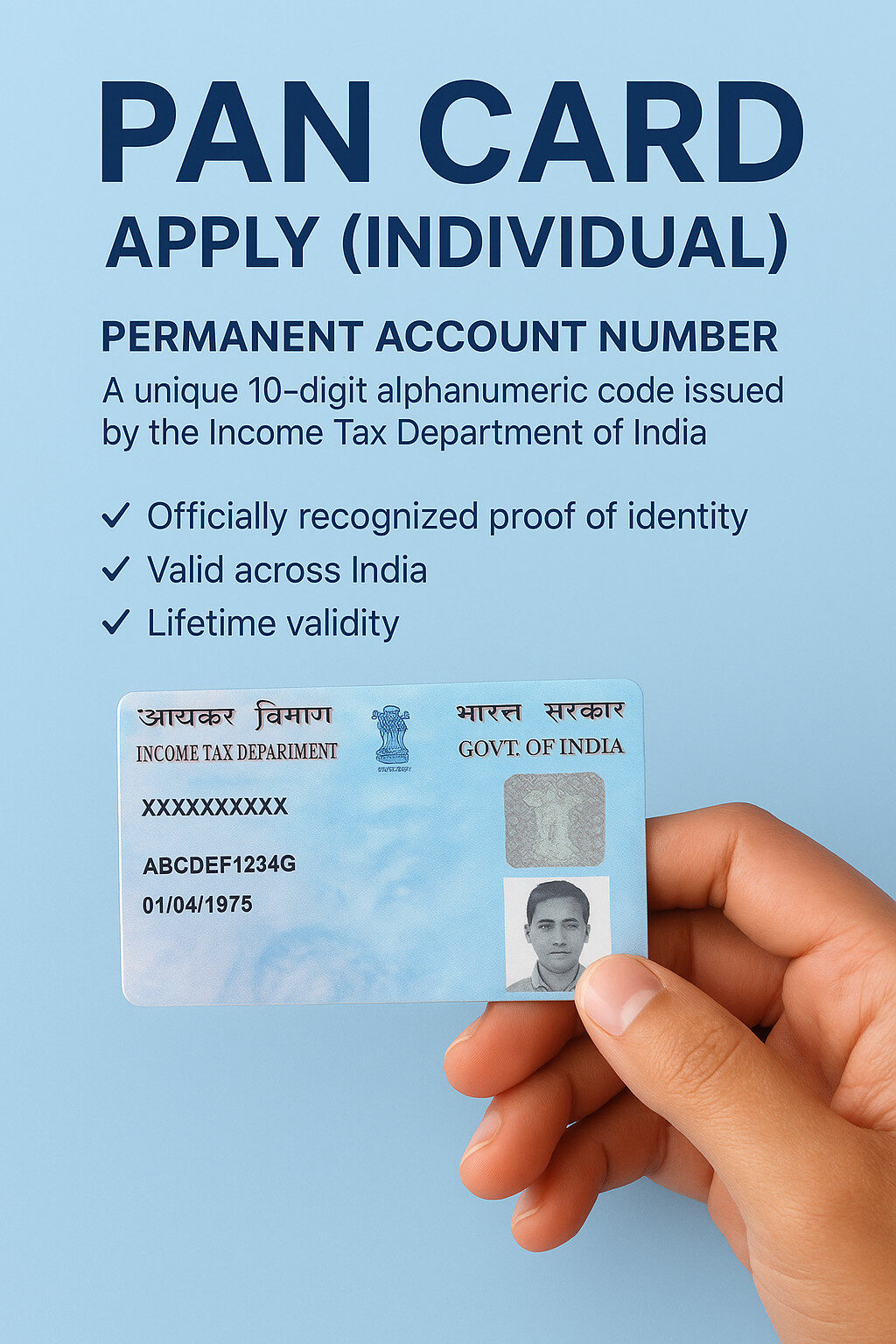

Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It serves as an essential identification for individuals for all financial transactions, income tax filings, and verification purposes.

By applying for an Individual PAN Card, you get an officially recognized proof of identity that is valid across India.

Key Features:

Unique 10-digit alphanumeric number

Mandatory for income tax filing

Required for opening a bank account, demat account, or applying for loans

Essential for high-value financial transactions

Accepted as valid ID proof across India

Eligibility:

Any Indian citizen (Resident or Non-Resident)

Individuals above 18 years

Minors can also apply (with parent/guardian details)

Documents Required:

Proof of Identity (Aadhaar Card, Voter ID, Passport, Driving License, etc.)

Proof of Address (Aadhaar Card, Utility Bill, Passport, etc.)

Passport-size photograph

Benefits:

Lifetime validity

Universal proof of identity for financial purposes

Helps track financial transactions and prevent tax evasion

Required for receiving taxable salary or professional fees

Reviews

There are no reviews yet.